Annual General Meetings

- Home

- Investor centre

- Annual general meetings

Bendigo and Adelaide Bank's 2025 AGM

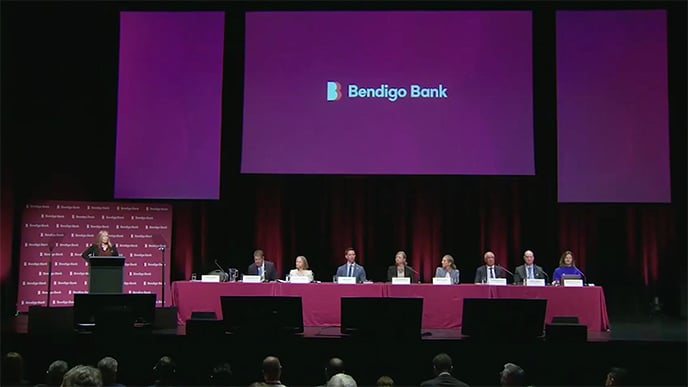

The Annual General Meeting (AGM) of Bendigo and Adelaide Bank Limited was held at 11.00am (AEST) on Tuesday 21 October 2025 at Ulumbarra Theatre in Bendigo.

AGM: Bendigo and Adelaide Bank Limited

Date: 21 October 2025

Time: 11:00am AEDT

Operator: Welcome to Bendigo Bank's 2025 Annual General Meeting. Now our Chair, Vicki Carter.

Vicki Carter: Thank you for that very warm welcome and good morning. I am Vicki Carter, Chair of Bendigo Bank, and I'm also a fellow shareholder. It's just after 11:00am and we have a quorum. I declare the Bank's 2025 Annual General Meeting open.

I acknowledge the Traditional Owners of the many lands that we're meeting on here today, and I recognise their continuing contribution to land, water, culture and community. I pay my respects to Elders past, present and emerging. I'm on the Traditional Lands of the Dja Dja Wurrung and Taungurung peoples of the Kulin Nation, the Traditional Custodians of this land and the waterways including the Loddon and Avoca rivers in the Bendigo region.

We welcome and we thank you very much for joining us here today. I'd like to make a special acknowledgement today to our former managing director, Marnie Baker, who is here. It's lovely to see you as always, Marnie. Thank you for being here.

Please place your mobile phone on silent. Photography, filming and audio recording are not permitted here today. For those joining remotely who are deaf or hard of hearing, closed captions are provided. However, you will need to press the CC button to activate these. A hearing loop is available here in the Ulumbarra Theatre.

For those of you who are vision impaired, I have straight, light, shoulder-length hair. I'm wearing a black jacket and a burgundy shirt. Behind me is a large image of the Bendigo Bank logo. The transcript of this AGM will be available after the meeting.

Out of respect for those who have joined us here today, we won't release early voting details. We'll provide those voting details as we progress through the meeting. That provides a level of transparency that we think is appropriate.

Let me introduce you to your Board and fellow shareholders. Alongside me is Richard Fennell, our CEO and Managing Director. Our Non-Executive Directors here with you today are Victoria Weekes, Alistair Muir, Margaret Payn, Abi Cleland, Daryl Johnson, and Travis Dillon. At the end of the table is Belinda Donaldson, our Company Secretary, who'll be assisting us with today's meeting.

I'd also like to acknowledge that in attendance today we have the Bank's executive team and also the Bank's lead audit partner, Clare Sporle, and incoming partner, John MacDonald from Ernst & Young. Also in attendance, we have Jim Kompogiorgas from MUFG, who's acting as our Returning Officer for this meeting. Our Head of Corporate Affairs, Lauren Andrews, will also be assisting today and she'll now outline the formalities for today's meeting. Thank you, Lauren.

Lauren Andrews: Thanks, Vicki, and good morning. Today's proceedings are structured to allow all shareholders or their proxyholders to participate in the business of the meeting in an orderly fashion. The Notice of Meeting contains details of how business will be conducted. We welcome questions from shareholders in attendance and online. When asking questions, please be courteous, fair and respectful. Also, keep questions concise and relevant to the meeting business. To maximise participation, the Chair will take up to two questions per shareholder for each item of business. Questions about personal matters will not be put to the meeting. However, Bank representatives are available to assist with queries.

For those who submitted questions ahead of the meeting, each question has been considered and either replied to directly or will be addressed today. Voting on each proposed resolution will be by poll. Registered holders of the Bank's ordinary shares at 7:00pm Australian Eastern Daylight Time on Friday, 17 October 2025 may vote on all resolutions. Guests are not permitted to vote or ask questions. Shareholders attending in person should have registered at the desk on entry. If you have not voted already or appointed a proxy, you will have been issued with a yellow voting card. MUFG staff are available to assist you.

Shareholders attending virtually can ask questions and submit votes online using any web browser on any device. Instructions are in the Notice of Meeting and on our website. As mentioned, questions relating to personal matters will not be addressed at the meeting.

Once the Chair has moved through the items of business requiring formal resolution and after all questions have been taken, we will display and read aloud the proxy results that were submitted ahead of the meeting for each resolution. As soon as voting opens, you will be able to vote on all resolutions. Voting is limited to the number of shares held and is subject to applicable voting exclusions.

If unforeseen technical issues arise, the Chair will provide further steps. If the meeting cannot proceed, details will be released via an ASX announcement. Thanks for your participation. I'll now hand back to Vicki for the Chair's address.

Chair’s Address

Vicki Carter: Thank you, Lauren. It is a privilege to share with you the progress made and to chart the path ahead for the Bank as the Board guides and supports our capable and committed leadership team through the next phase of growth. The Board remains focused on delivering sustainable growth for the benefit of our people, our customers and for you, our shareholders. Bendigo Bank has entered this financial year in a very strong position. The completion of our final phase of our transformation program, which began in 2018, has paved the way for a new strategy anchored in our unique strengths and accelerated by new ways of working to drive improved returns for you, our shareholders. Our purpose of feeding into the prosperity of our customers and the community remains. In order to deliver on our purpose, we must continue to innovate. Across every part of the Bank, we are actively looking for ways to do better and at a time of constant change, innovation is not an option for us, it is essential. Bendigo Bank CEO, Richard Fennell, will share more details of the new strategy with you shortly.

This year, the Board has determined to pay a fully-franked final dividend of $0.33, taking the full-year dividend to $0.63. That's a stable result on the comparable period and we remain committed to investing the capital required to support our 2030 strategic initiatives. We continue to be mindful of the need to balance providing shareholders with an appropriate return on their investment and the need to maintain our solid capital position.

As part of this, the Bank made the difficult decision to consolidate or to close 10 branches and retire the agency model earlier this year. This decision followed a review of evolving customer preferences, a reduction in business activity and an increase in costs and compliance obligations. The Bank is cognisant of the impact to customers who have been inconvenienced by this decision and we want to assure you that in making these decisions, we ensure that viable banking alternatives are available for our customers. Bendigo Bank is committed to maintaining a strong physical branch network and also those personal interactions that happen every day in our branches. The Bank maintains more branches per customer than any other bank in Australia and we are the second-largest regional bank network in the country. To remain competitive, we will need to continue to invest strategically in our networks and in those channels that are preferred by our 2.9 million customers.

One of the ways that Bendigo Bank distinguishes itself from our peers is through the significant community dividends it distributes each and every year. Our unique community bank model is the most tangible example of how we deliver on our purpose and it continues to generate lasting benefits for the wider community. In financial year '25, the model returned a record $50.2 million across more than 9,000 community strengthening sponsorships and grants. Initiatives are wide ranging and include the funding of laptops for primary school children in Beaufort, Victoria; emergency housing for women over 55 in Fleurieu, South Australia; and an oncology nurse at the hospital in Bunbury, Western Australia. The Community Bank model has now returned more than $416 million back to the community since inception, making a significant impact on the lives of our customers and on their communities. We are proud of our Community Bank model and will continue to work hard to preserve what makes it special for future generations.

In conjunction with our community bank partners, the Bank awarded 348 students with scholarships last financial year, valued at $1.1 million. Bendigo Bank's scholarship program is one of the largest in Australia and it has supported more than 2,300 students with scholarships valued at more than $15 million since 2017. We're especially pleased to support an initiative that removes barriers to education for regional, rural, Aboriginal and Torres Strait Islander and agricultural students who might otherwise have missed out on the opportunity for further education. Significantly, many of these students return to the regions to become part of the next generation of leaders and community and essential workers.

The program is managed by our philanthropic arm, the Community Enterprise Foundation. The Foundation supports community recovery from natural disasters and focuses on building resilience in affected communities and the management of the impacts of disasters, which we know can be felt for many years after the event. More than $1.3 million has been distributed to impacted regions over the financial year. This financial year, the Bank was pleased to support administration of $10 million in payments from the Victorian Government's Farm Drought Support Grants program to support on-farm infrastructure and provide drought management and preparedness for our customers.

Work to protect customers and the community from scams and fraud is important and ongoing. The Bank pleasingly reported a 36% fall in customer losses in financial year '25, which came off the back of a 34% fall in the previous financial year. Banking Safely Online, which is our face-to-face education program for our customers and which is designed to build their confidence in transacting online, remains very popular. We've had over 260 sessions helping thousands of Australians and will continue to do that throughout our branch network as we progress. Cyber fraud remains a complex, evolving and ongoing challenge. The Bank continues to work closely with our peers in the financial sector, with government, regulators, law enforcement and others to detect, prevent and respond to cyber fraud.

Bendigo Bank remains committed to supporting our customers and communities, and we continue to think deeply about how best to align our community-focused initiatives with our business for greater societal impact and sustainability. The process of renewal at Board level has continued to ensure a diverse and complementary mix of experience and expertise, and that is ongoing. Career banker and experienced Non-Executive Director, Daryl Johnson, was appointed to the Board in September 2024 and Agribusiness Executive and Non-Executive Director, Travis Dillon, was appointed in February 2025. Their perspectives and contributions have been invaluable for our Board. Richard Deutsch resigned in September 2025 for personal reasons after four years of terrific service. Richard is a highly regarded and respected director and colleague. The Board expresses its deep gratitude to Richard for his contribution and we wish him all the best for the future.

On behalf of the Board, I'd like to thank you, our shareholders, for your continuing support. We do not take your loyalty for granted and we consider ourselves very fortunate to have such an engaged and active shareholder base. And finally, I'd like to thank all of our people and partners across the country who've worked tirelessly throughout this year to directly support our communities and our growing base of more than 2.9 million customers.

Thank you. I will now hand over to Richard for the CEO's address.

CEO’s Address

Richard Fennell: Thanks, Vicki, and good morning, everyone. In the 2025 financial year, Bendigo Bank has continued to demonstrate the value of a balanced approach in a competitive and challenging environment. Bendigo Bank occupies a unique place for customers and communities, and we must work hard to ensure we continue to meet their expectations while delivering improved returns for you, our shareholders.

Over the last 12 months, the Bank has continued the important foundational work that is setting us up for sustained success, while keeping our commitment to supporting customers whenever they need us. The work being performed to simplify and modernise continues, and the Bank remains on track to reach the target state of one core banking system by the end of this year, down from eight in 2019, further streamlining our business.

After six years of reducing complexity, building capability and telling our story to more Australians than ever before, the time is now right for us to focus on the next horizon without losing sight of what has made our Bank successful over so many years: our support for our customers and their communities.

Last financial year, Bendigo Bank finalised a refreshed strategy for the next five-year period and shared it with our people. I'm pleased to also share it with you today. Importantly, our longstanding purpose of feeding into the prosperity of our customers and the community has not changed. Our 2030 strategy is underpinned by five pillars. First, make life easy with digital; second, operate simply and efficiently; third, deepen customer relationships; fourth, set the benchmark for trust and societal impact; and fifth, reinvent banking for a new generation with Up. These areas of focus will be supported by key enablers: uplifting our risk management capabilities; streamlining our technology foundations; and strengthening our performance culture through an operating model that aligns with our strategic objectives.

We've refreshed our targets with a return on equity target of more than 10% by 2030, generating improved returns for you, our shareholders. This target will help to guide our strategy, decision-making and execution. To deliver on this target, we will immediately focus on the following areas: optimising our deposit franchise by taking a deposit-led approach to growth, utilising lower-cost deposits as our primary source for funding; enhancing productivity, using strategic partnerships to support innovation to offset the increased amortisation costs and enabling access to market-leading technology and capabilities; and finally, delivering sustainable growth by prioritising lending growth in our highest-returning channels, focusing on segments and opportunities that exceed our cost of capital. The ability to execute these initiatives and deliver on the strategy will be supported by our newly created Strategic Execution Office, which reports directly to me. I look forward to updating you on our progress with our strategy in future years.

With this new renewed focus, we're doubling down on what matters most: helping our customers thrive and strengthening Australian communities. A new, modern operating model that leverages strategic partnerships and innovation for structural efficiencies and better customer experiences will be critical to our success. In the final quarter of financial year 2025, the Bank began the first phase of a productivity program which impacted over 100 roles across several business functions. The Bank consults with its employees whenever changes are proposed that impact them, ensuring those affected have the support they need. The health and wellbeing of our people is a key consideration in the planning and implementation of workplace changes. Later phases of this productivity program will likely result in further necessary changes to our workforce as the Bank prioritises investment in continued innovation and development that supports the evolving expectations of our customers. As we continue to innovate and make changes, we know that we must engage authentically, staying true to our values and our identity as a proud regional bank. The Bank is committed to being open and honest with our people about changes that will set us up for success, in line with our strategic pillar to operate simply and efficiently.

Last financial year, the Bank's disciplined approach to the allocation of capital and the pricing of our products continued to deliver benefits for our stakeholders. Following a first half that saw a significant increase in demand for our products that placed our margin under pressure, the second half saw the Bank deliver more moderate growth and a stabilisation of the net interest margin at 1.88%, leading to cash earnings of $514.6 million for the year. Expenses were higher year on year, largely due to the planned increase in investment spend, which saw total operating expenses up 7.7%. Contributing to this was the increase in costs due to wage and price inflation, technology costs and software amortisation. Pleasingly, our business-as-usual expenses, which exclude investment spend, were well below inflation for the second half, and we continue to target BAU cost growth to be no higher than inflation through the cycle.

Our customer numbers have continued to grow faster than any other major or regional bank, rising 11% last year to 2.9 million customers. Demand for our lending and deposit products continued to grow over the year, increasing 6.3% and 6.6% respectively. Customers do want to bank with us and are attracted to our quality products, personal service and our unique purpose. Our high standing with customers is reflected in our Net Promoter Score which remains very strong at plus 28 points, well above the industry average. But we do not take our market-leading customer advocacy for granted. Maintaining our culture and our customer and community focus continues to be among our highest priorities.

As part of our year-end processes, the Bank is required to test the carrying value of our goodwill. Following a review, the Bank determined to record an impairment to the value of its goodwill of $539.5 million. This decision, driven by heightened levels of global uncertainty and the outlook for longer-term discount rates, has not impacted the Bank's ability to pay a dividend, nor its regulatory capital levels. The Bank's full-year dividend of $0.63 for financial year 2025 was stable on the previous year, and our Common Equity Tier 1 ratio of 11% as of 30 June 2025 remains well above the Australian Prudential Regulation Authority's definition of unquestionably strong. Our strong capital levels will ensure Bendigo Bank is well positioned to support our customers through both good times and challenging times.

Pleasingly, most of our customers continue to show great resilience, with 87% of our home loan customers maintaining a financial buffer, including 42% of them at least one year ahead on their repayments and 31% two years ahead. The outlook for underlying credit quality remains strong as the impact of interest rate cuts come through. After a period of sustained cost-of-living pressures, the Bank has been pleased to offer many homeowners interest rate relief, with three 25 basis point reductions to the standard variable rate.

One of my personal highlights for the year was the finalisation of our new executive team, with the addition of Fiona Thompson as Chief People Officer in December 2024; Kerrie Noonan as Chief Risk Officer in February 2025; and Kieran O'Meara as Chief Technology Officer in April 2025. These additions complement the September 2024 internal appointments of Taso Corolis as Chief Customer Officer, Consumer Banking; Sarah Bateson as Chief Marketing Officer; and Xavier Shay as our Chief Digital Officer, in addition to his existing role as CEO of Up. We are very fortunate to have such high-quality leaders with deep expertise and strong experience.

Before I conclude, I want to convey to you just how excited I am about the future of Bendigo Bank. I am confident we have the right team in place to execute on our strategy and preserve what makes our Bank special, by reaching refreshed targets and improving returns for you, our shareholders. On behalf of the Board of Directors and executive team, I would like to thank our many talented and dedicated team members for their hard work and commitment and our shareholders for your ongoing support as we continue to sharpen our focus on driving value and sustainable returns. Thank you.

Formal Business

Vicki Carter: Thank you, Richard. I'll now turn to the formal business of the meeting. The first item relates to the Bank's Financial Report, Directors' Report and Independent Auditor's Report for the financial year ended 30 June 2025. The 2025 Annual Financial Report was made available to shareholders in August. Our external auditors, Ernst & Young, issued an unqualified opinion on the financial report. There is no requirement for shareholders to vote on this item of business. Ahead of the meeting, shareholders were provided with an opportunity to submit questions to the auditor about the content of the Auditor's Report and the conduct of the audit of the Annual Financial Report and none were received.

I'll now take any general questions on the reports, other general matters or questions for the auditors. Given this is a hybrid meeting, I'll rotate between shareholder questions submitted in advance, questions from shareholders here in person and also those coming in online. Lauren, could you begin with some of the most common questions submitted please?

Lauren Andrews: Thank you, Vicki. Shareholders David Sproul, Peter and Marie South, Townie Downs Super, Ian Sanders, Janice Hutton, Glenda Cheeseman and Fay Dubignon have contacted us regarding branch closures. Their questions can be summarised in the following way: Why have you closed some branches including in smaller regional areas?

Vicki Carter: Well, thank you to all of you for that important question. As you heard me say in my opening, we did take the decision to close 10 branches on the back of an extensive review across the network. Those decisions are not taken lightly. They are actually informed by customer preferences, and we know today that 99% of banking is done digitally. So, we did need to respond to that. In those instances as well, we were looking at a growing cost base and also business usage which informed the decision. As I said and I think Richard reiterated, we do take steps to ensure that customers have alternative arrangements that are practical for them, and we do our best to identify our vulnerable customers to ensure that they are supported through the transition. What I would say is we won't necessarily always get to everybody that we may need to and if there are customers out there who need our support in making that transition, we are available and we'd like them to get into contact with us. Thank you.

Lauren Andrews: We have a question from Janice Hutton about branch service levels. Ms Hutton asks, "Why are queues in your banks often 30 to 60 minutes long, with the minority of staff acting as tellers? Why are you making older customers stand?"

Vicki Carter: Well, thank you, Janice, for that question. We don't want any of our customers to be standing in a queue for long periods of time, let alone those of us who are a little older. We're doing considerable work to ensure that that's not the experience that you'll receive going forward. So, from a technology perspective, we've invested in our Bendigo Lending Platform. That platform is being rolled out to all of our branches by the end of this year. It will create significant capacity for our people in our branches to spend more time with customers. We also have people who are walking our queues, talking to customers to educate them about other ways to bank within the branch or indeed online. So, I apologise that that's been your experience and can assure you that we are progressing work to address that. Thank you.

Lauren Andrews: We have a question from Tim Lovell about our people and culture in the context of recent organisational changes. Mr Lovell asks, "What is being done to improve morale and culture at the Bank, given the Bank's performance relies on the performance of its people?"

Vicki Carter: Thank you. Another terrific question, Mr Lovell. Look, people are very much at the heart of our business. Our culture is a strong culture and a proud culture and that continues, but we do understand that change can be challenging for people and what we do is engage very authentically and transparently around that. So, if people are going to be impacted by change, we're very transparent with them about that. We seek opportunities for redeployment where those opportunities exist and if ultimately people leave the Bank, we ensure that they have appropriate support to make that transition as well for them as we possibly can. It's important as well that we continue to recognise our many people in the Bank and so, to that end, we've launched a Group-wide recognition program which is very much in line with people living our values and being rewarded and recognised for doing so. So, we are taking a number of steps to make sure that our people continue to be supported. Thank you.

Lauren Andrews: We have a question from shareholder, David Bryce, about Bendigo Bank's digital offering. Mr Bryce asks, "CBA is noted to distinguish itself from other financial institutions in Australia by its technology advantage. How advanced is Bendigo Bank with the technology it makes available to customers?"

Vicki Carter: Thank you. Thank you very much for that question. Look, you will have heard the first pillar of our strategy is around providing customers a better experience with digital. We've had some very strong proof points in recent years. So, I mentioned earlier our Bendigo Lending Platform and that was rolled out last year. That's now had $8.6 billion in loans go through that platform. It will be rolled out to the rest of our branches by the end of this year, so a very significant step forward. Our digital onboarding experience will allow our customers to actually sign up for an account with us within less than five minutes. So, that's another strong capability that will be available to our customers at the end of next month. Also, we have a very, very strong digital bank which is Up. So, Up now has 1.2 million customers. Its app is rated amongst the best in Australia. Last year, they more than tripled their home lending growth and their deposits grew by in excess of 34%. So, a very, very strong digital bank there and there's certainly more to come and we are deeply investing in our technology to create a better experience for our customers. Thank you.

I'd now like to take some questions from those shareholders who are in attendance today and we'll take these questions one at a time to ensure that everybody gets an opportunity to ask their questions. Please feel free though to line up again if you have another question. As mentioned earlier I'll take up to two questions from each shareholder for each item of business. One of the Bank's senior leaders, Collin Brady, is here with us today in the audience and ready to facilitate your questions and I'd now invite shareholders or proxyholders to move to the microphone to submit questions. Please ensure though that you do show your proxyholder card and also provide your full name so that we can introduce you to the meeting. Thanks, Collin.

Collin Brady: Thank you, Vicki. The first question from the auditorium is from Eric Pascoe, proxyholder for the Australian Shareholders' Association.

Eric Pascoe (Australian Shareholders' Association, Representative): Good morning, Madam Chair. I'm a proxyholder representing the Australian Shareholders' Association. We hold 2 million proxy votes, representing 225 shareholders. Madam Chair, Bendigo Bank's Achilles' heel is clearly its costs. An almost 8% growth in cost versus virtually flat revenue can only lead to a disappointing profit result. Will this Board give shareholders a firm undertaking that you will have a laser focus on cost reduction this year? And what is the budgeted cost-to-income ratio target figure for FY26?

Vicki Carter: Thank you, Eric, for the question and thank you to you and Norm for spending time with us in the lead up to the AGM; we do appreciate it. I can assure you that costs are a focus for the Board and for the executive team. Last year, the costs Richard mentioned were up over 7%, and we did talk about the fact that much of that was on the back of the investment in our strategy. We'll continue to make those investments because they're important to provide the sort of experience that we want for our customers. Also, amortisation and wage inflation were part of that as well. Richard also mentioned in his speech our productivity program that we've already seen good results from and that there will be more to come in that regard as well. And so we're very, very clear about the need to stay focused on that and I speak on behalf of the Board. As recently as yesterday, we were having our Board meeting and certainly, that was a significant area of focus, so we've got it.

Moderator: Vicki, our next question is from Ben Pearce, proxyholder for the Citizens Party.

Ben Pearce (Australian Citizens Party, Representative): Thank you. Last year, a Senate inquiry recommended that the Australian Government adopt a policy recognising access to financial services as an essential service and to investigate the feasibility of establishing a publicly owned bank, including within the branch network of Australia Post as an option. Is Bendigo Bank preparing for franchisees or community banks to jump ship if a government bank offered them a better deal and left them to do their jobs as community banks?

Vicki Carter: No, we're not preparing for them to jump ship. I think you heard both Richard and myself talk about the importance of the community banks to Bendigo Bank and our network and we remain absolutely committed to ensuring that community banks want to continue to partner and to work with us. We do understand that banking services more broadly need to be provided, and Australia Post has filled a notable gap where that's been available for customers. So, we're actually pleased with the level of focus that the government and others have on providing regional banking services because we think it's an important discussion to have and we're very much at the forefront of that discussion. Richard certainly spends time in Canberra having those discussions and through the ABA as well. We remain committed to our community bank.

Collin Brady: Thank you, Vicki. The next question is from Scott Batchelor, proxyholder for the Finance Sector Union.

Scott Batchelor (Finance Sector Union, Representative): My question is for Richard Fennell. The 2030 Group strategy used vague language such as "efficiencies" and "optimisation". At the same time, we have already witnessed widespread job cuts across Bendigo Bank this year. Elsewhere across the industry, we've seen large-scale job cuts, such as 3,500 job cuts at ANZ and cuts at CBA and BOQ and further cuts on the horizon. What guarantees can you give our members and your employees around job security?

Richard Fennell: Thank you for your question. The reality of this industry and the way that our customers choose to deal with us is that we will continue to need to make investments in technology and other attributes to meet that demand. That means over time we'll need to reshape the structure of our organisation to make sure we've got the skills and capabilities we need to meet those expectations of our customers. Now, from time to time, that will mean that we need to restructure our functions and the roles within those functions. The unfortunate reality of that means that some roles cannot be guaranteed on a forever basis. So, I can't give a guarantee that every role within our Bank will be there forever. Things change. We need to change with the changing demands of this industry from a regulatory perspective and also from a customer perspective. Where those changes do occur, we will look to support our people as best we possibly can through those transitions. When those transitions do happen, we do everything we can to find other opportunities for them in the Bank, and that will be maintained as a key focus for us going forward. Thank you.

Collin Brady: Vicki, our next question is from Lachlan Curran, proxyholder for the Finance Sector Union.

Lachlan Curran (Finance Sector Union, Representative): Thanks. My question is also for Richard Fennell. Bendigo Bank says its purpose is to feed into the prosperity of its customers and communities. However, this year to date, the Bank has closed 10 branches and closed its regional agency network, leaving 20 regional communities without any banking service. In the town of Queenstown in Tasmania, where Bendigo Bank withdrew from the community, thousands of residents are forced to do a four-hour round-trip to access a bank, and the local Australia Post reported running out of cash, unable to keep up with the banking demands of residents. Are there plans to abandon any more communities and close more branches?

Richard Fennell: We have no current plans to close any further branches.

Vicki Carter: Thank you for your question.

Collin Brady: Vicki, we have another question from Eric Pascoe, proxy for the Australian Shareholders' Association.

Eric Pascoe (Australian Shareholders' Association, Representative): Madam Chair, perhaps on a positive note, it appears that the Mastercard attached to an Up Bank account is taking the travelling public by storm. Everyone is talking about the fabulous new card that has no bank fees, has excellent international exchange rates, works superbly at home and around the world, and gives you instantaneous reporting on your phone. It's great that Bendigo Bank is responsible for what I think is such an exciting product. How is it that Up Bank can provide such a card and is this costing the Bank and thus, shareholders, to provide what is an excellent service?

Vicki Carter: Thank you, Eric. I really appreciate your appreciation of the Up card and it is a fantastic feature. You use it, we use it, I use it. It simply is the case that because Up is a digital bank, it doesn't have a lot of legacy assets or a cost base, so we're able to pass through the rate that we get from Mastercard directly to our customers. So, it really is as simple as that. It doesn't cost Bendigo anything to provide that, but we are delighted that you're enjoying the experience of that and we encourage more people to take a look. Thank you for the question.

Moderator: Vicki, from the auditorium again, we have another question from Ben Pearce, proxyholder, Citizens Party.

Ben Pearce (Australian Citizens Party, Representative): Just a quick follow-up question on the issue of the closure of the Queenstown branch in Tasmania. Did the Queenstown branch stop being profitable in the two years it was back under corporate control? And if so, how?

Richard Fennell: Look, we do not provide individual branch profitability numbers. The reality of that branch is we were only able to open it two days a week for a total of 11 hours. The cost of fitting out and maintaining a branch that is only operating for 11 hours a week, including security requirements and the like, was a significant cost for very limited demand in that town. It was a difficult decision. We've spoken at length to the community down there. We understand the disappointment of some community members, but the reality is that the demand for in-branch services did not align with the value we saw in keeping that branch open on an ongoing basis.

Vicki Carter: Thank you for the question.

Collin Brady: Next question, Vicki, is from Geoffrey Donald, shareholder.

Geoffrey Donald (Shareholder): I would like to know, do you know what this number means: 1300 236 344? Because I've used it a number of times with excessively long waiting times, so there must be a lot of people out there with lots of questions to get answers for the problems of this double identity check and other things. Later, it seems to run overtime and there's nobody there. So, does it actually shut down overnight? So people don't have to waste their time listening to that message over and over again. There must be an awful lot of people, or the queue management of these things is not up to standard. I wondered if there's anybody actually monitoring how many calls are being made at any one time to bring in more staff, instead of having people sitting there listening to the same drone over and over again. Thanks.

Vicki Carter: Thank you. Thank you, Mr Donald. Actually, we do monitor it. We do monitor our contact centre and, in fact, have recently added resources to the contact centre and also reviewed the rostering to make sure that there's appropriate coverage for weekends, et cetera. We have actually improved wait times by more than 75% in recent months, but I do apologise that that's been your experience.

Collin Brady: So, just a follow-up question from Geoffrey Donald, shareholder, Vicki.

Geoffrey Donald (Shareholder): At any one time, how many people would you expect to have to wait? And overall, how many people actually wait per week? Because it seems to be an awful lot of people whenever I've tried to ring up about problems I have with banking with the Bendigo Bank.

Vicki Carter: I wouldn't be able to tell you each week what those numbers are, Mr Donald. What I can tell you is that we have added resources to the contact centre and we are already seeing a reduction in wait times on the back of that. So, I would hope that your experience will be better going forward. But I appreciate the frustration, I do. It's because of the complaints from people like yourself that we've needed to take steps to make sure that we address those issues and that we add to our staff and create a better experience for our customers. So, thank you for raising it.

Collin Brady: Thank you, Vicki. Our next question from the auditorium is from Norm West in proxy for the Australian Shareholders' Association.

Norm West (Australian Shareholders' Association, Representative): And a shareholder of a few years standing. I'd like to endorse my colleague's comments about Up. I think the Bendigo Bank is probably missing out a little bit. It's very, very good for the younger generation, but it's equally good for the older generation. From all the grey hairs I can see from back here, please take note. However, the question I'd like to ask is about its success. What makes Up unique and what copyright do you have? Because I'm sure there are other banks in Australia looking at it and in the last couple of days, there's been a write-up overseas about a card with very, very similar characteristics. So, how can you protect your own success as it becomes more successful?

Vicki Carter: Thank you, Norm. Terrific question and again, we appreciate your contribution before the meeting and today. Look, I think with Up, there are certain things that other organisations can replicate. What they would struggle to replicate, I think, is the very deep connection that Up has with its customers. So, it very much democratised banking, made banking accessible and works with its customers to help them to grow and help them to learn to save and provides them with choice. So, the brand itself is loved by its customers. The NPS on Up is 55-plus points. That is massive. So, it's about the products which are terrific. They're well designed. They come from human-centred principles, but it's also about that love of the brand and what it enables for people. The business is performing very well. Starting from 500 customers to having now 1.2 million customers is no mean feat and the business, as I said, last year tripled its lending and deposits are pretty much the same as well. So, it is going very well. It's certainly on the path to profitability. The other thing that I would say is I talked earlier about our own onboarding experience for our customers through Bendigo. We're very much leveraging the capability of the Up team to make sure that some of what they do incredibly well is actually translating into the experience for our Bendigo customers as well. So, we're getting enormous value through the Up business. Thanks for the question.

Collin Brady: Vicki, our next question is from Lachlan Curran, proxyholder for the Finance Sector Union.

Lachlan Curran (Finance Sector Union, Representative): Thank you. My next question is also for Richard. So, in Bendigo Bank's 2030 Group strategy, the Bank aims to leverage artificial intelligence and automation to operate simply and efficiently. Across the finance industry, we are witnessing Australian jobs being replaced with AI. There are a few parts to this one. So, how much is Bendigo Bank investing in AI and automation? What are you doing to train and upskill staff so that they can work with AI? And what guarantees can you give today to Bendigo Bank employees and our members that their jobs will not be replaced by AI and automation?

Richard Fennell: Yes, thanks. Really good question and really topical question. We see AI as a great opportunity to support our people in doing their jobs. I'm not going to reveal an exact number on how much we're investing, but we are investing in the AI space. An important part of that investment is actually training our people so they can use AI to better undertake their role and to better service our customers. So, this is going to be a continued area of investment for us to hopefully make life easier for our people in servicing our customers. The primary focus of this is not about reducing headcount or taking roles out, but to allow us to better and more productively meet our customer needs. So, excellent question, thank you.

Vicki Carter: And Lachlan, I'll just add to that as well. I mentioned in my opening that we have seen a significant reduction in financial crime over the last 12 months and before as well. We've significantly leveraged AI capability to detect patterns in behaviours that have helped us to achieve those results. So, it is often, as Richard said, about augmentation and helping our people to be able to do their jobs better and that can lead to very significant outcomes for customers as well.

Collin Brady: The next question, Vicki, is from Scott Batchelor, proxyholder for the Finance Sector Union.

Scott Batchelor (Finance Sector Union, Representative): My question is also for Richard Fennell. According to the Workplace Gender Equality Agency annual report, Bendigo and Adelaide Bank's gender pay gap is 22.6%. What measures are the Bank implementing to address this for more than half of your workforce?

Richard Fennell: Yes. Look, it is something that is very top of mind and something that we want to actively see reductions in that gender pay gap. One of the key drivers of that is the construct of our workforce and what we need to do is get a better gender balance in some of the roles that are more customer facing and tend to earn less. In those particular roles through our branch network and contact centres, we have a heavier gender balance to female members of our staff than male members and that does have a negative impact. We also need to make sure we support more female leaders to come through the organisation to take more of the leadership roles in the organisation. I'm very pleased that three of the nine executives that report to me around the executive table are female. I'd like to see that come into balance over time. But this is a key area of focus for us and we certainly recognise this is a challenge that we need to actively respond to. I'd certainly agree with you, the current performance there is not one that we're proud of, and we do want to see that improve.

Collin Brady: Vicki, there are no more questions from the auditorium.

Vicki Carter: Okay. Thank you, Collin. I'll come back to in-person questions, but to ensure we allow everyone to participate, Lauren, can we please now take questions that are coming in online for those joining remotely today?

Lauren Andrews: Yes, Vicki. We have a question from Mrs Patricia Anne Sarah Vorchheimer. Her question is, "As electricity supply and digital connectivity are unreliable in many regions, what are we doing to ensure people in regional and remote areas are still able to access banking services when needed?"

Vicki Carter: The Bank doesn't, obviously, have a way to ensure that electricity supply or networks are provided in regional Australia other than through advocacy, which we do take seriously. We predominantly find that access to our online banking services is provided for customers across Australia. It will depend on people's own arrangements of course, but we're not aware of issues necessarily through remote areas for digital banking for Bendigo customers. But I think it's an important question which probably needs to be addressed at a more systemic level across Australia. Thank you.

Lauren Andrews: Our next question is from Michael Francis Sanderson. He asks, "Bendigo Bank says branch and agency closures reflect reduced use, a digital shift and the need to be sustainable. A 2024 Senate inquiry called banking an essential service and proposed a public bank. With towns left without a bank and your deposits publicly guaranteed, why haven't you supported the establishment of a public bank?"

Vicki Carter: Thank you. I think we had a similar question earlier on today which I answered. We're a very proud regional bank. We are a private organisation. Public banks and the establishment of those are for the government. They're not for our consideration. But thank you for the question.

Lauren Andrews: We have a further question from Michael Francis Sanderson. "In the context of historical US credit swings and with Australian household leverage still high, how will Bendigo Bank protect shareholders if credit is negative for several quarters and collateral falls? How do you consider loss assumptions, capital, provision overlays and the dividend?"

Vicki Carter: Well, thank you. We're certainly in a strong capital position, which you'll see reflected in our Annual Financial Report. Our dividend has been stable this year with the comparative period. So, we're in a strong position there. I think you heard Richard talk about our customers and their resilience during this period as well. So, whilst there is a slight uptick in arrears, we still have most of our customers with significant buffers and we are not experiencing credit losses that should be of concern to shareholders. Thank you. Lauren, do we have any further questions submitted prior to the meeting?

Lauren Andrews: We do have a further question from shareholder Mrs Joy Woodford and Imalang Pty Ltd who have contacted us regarding pay equity. Their concerns can be summarised by the question, "What is the Bank doing to address the gender pay gap of 25.2%?"

Vicki Carter: Thank you very much for the question. It is a great question and I think Richard just answered it, so I'll only add a couple of things, which is to say that we are committed to 40-40-20 gender representation across our Bank and from the executive level, we're signed up to the HESTA 40% target as well by 2030. So, we're taking some real progressive steps there as well as ensuring that we're investing in women in leadership programs to get the next generation of women leaders coming through. One of the other very practical things I'll add as well is when we review remuneration on a yearly basis, we are deliberately setting aside funds to ensure that we are dealing with pay equity issues as well. So, there's a very large systemic opportunity here for us but there's also a tactical one, and so we take steps to ensure that we do both of those things to ensure that gender equity is not an issue for us in the future. Thank you.

Lauren Andrews: We have a question from Peter and Geraldine Sanderson about diversity and inclusion policies. They ask, "Does the Bank's Board actively support the removal of all DEI policies from the management and operation of the Bank and if not, why?"

Vicki Carter: So, I'll take from the question, just for the benefit of those listening in here with us today, that the question is about diversity, equity and inclusion. And no, emphatically, we do not support the removal of those policies. In fact, it's quite the opposite for Bendigo Bank. We strongly believe that diversity and diverse thought and experience provides a better bank for us and for our customers. It is important that we reflect the communities that we operate in and we know that with diverse perspectives comes more challenge, more robust debate, it makes us a better organisation and very importantly, it gives us access to the best talent in this country. So, very, very much in favour of maintaining our position on DEI. Thanks for the question.

Lauren Andrews: We have two questions from Mr Massoud Hussain on the issue of investment in physical assets. They can be best encapsulated by the question, "What plans does the Bank have to acquire physical assets such as gold?"

Vicki Carter: Thank you, Mr Hussain. No plans. We provide personal banking products for our customers. That's what we're focused on doing for now and in many years to come. We're not involved in physical assets or speculation, so thank you.

Lauren Andrews: Vicki, that concludes all the questions for this item of business.

Vicki Carter: Thank you, Lauren. We'll now move to the other formal items of the business as set out in the Notice of Meeting. Or, Collin, have you got questions there?

Collin Brady: We do have one question here from shareholder, Rex McKenzie. Thank you.

Vicki Carter: That's fine. Let's do that.

Rex McKenzie (Shareholder): Thank you. My question is about balancing security against efficacy, against the ability to get a job done. I noticed on reading the Annual Report, glancing through it, that there is almost a greater emphasis on security and, I mean, under current circumstances, that's not surprising, because of the threats to security that are new. What I'd like to know, though, is in getting a job done, sometimes there is this tussle. How long is this job going to take to do? And how much do I have to allow for a decision to be made early enough to satisfy the customer?

Vicki Carter: Mr McKenzie, are you talking about some of the steps that you need to go through to authenticate identity and those sorts of things?

Rex McKenzie (Shareholder): I'm talking about the general level of security in banks. APRA requires it and you have to make sure you're doing what's necessary. How do you make the decision when, in terms of balance of risk, to get this particular job done, knowing it mightn't be that serious?

Vicki Carter: I understand. The point that you raise about balance is actually the operative one. The reality is if we were trying to protect against every possible scenario from a cyber perspective, we probably wouldn't apply investment to anything else and there would be a level of friction in the customer experience that we don't think would be tolerated. But we do have an assessment of our most critical assets and that will be those that contain the most sensitive data for our customers, those that if they were penetrated would cause significant damage. So, that's how we balance up our investment. We look at the most critical assets, make sure that those are well protected and really, that's the sort of balance that we need to bring into it because as I said, you can't protect everything. We do want our customers to be able to interact with us without too much friction as well, but there are just some things that you must protect and that's what we apply our capital to.

Rex McKenzie (Shareholder): For my follow-up question, does a reduction in staff reduce the ability to respond more quickly under those circumstances?

Vicki Carter: I don't think so. If we have customers who have a particular security concern, we certainly have available staff to help them with that. I mentioned earlier as well about our Banking Safely Online sessions. We've run 260 of those throughout the country. Our teams in the branches are working with customers every day to show them how to bank more securely as well. So, I don't think we've seen a concern with that. And certainly, when we talked about the reduction in staff numbers earlier, and we've had questions here today from the FSU, that's not our customer-facing staff. Thanks, Mr McKenzie. So, no more there, Collin?

Collin Brady: No more from the floor, Vicki. Thank you.

Vicki Carter: Thank you. All right. So, we'll go now to the other matters, other items of the meeting and these items do require voting by our shareholders. So I'll now declare that voting is open on all items of business. Please submit your votes at any time during the meeting. I confirm where undirected proxies are directed to me, I will vote in favour of all resolutions to the extent permitted.

There are three Non-Executive Directors up for re-election and election including Victoria Weekes, Alastair Muir and Travis Dillon. The next item of business asks shareholders to consider and, if thought fit, to pass a resolution that Victoria Weekes who retires from office under Rule 72 of the Bank's Constitution be re-elected as a Director of the Bank. I'd like to invite Victoria to address all of you here today in support of her re-election. Thank you, Victoria.

Victoria Weekes: Thank you, Vicki, and good afternoon to our shareholders here with us today in Bendigo, and welcome to those joining online. It's an honour to be here today to be considered for re-election to the Bendigo and Adelaide Bank Board. I've been serving on your Board for nearly four years and consider it a great privilege. I currently chair the Board Risk Committee and am a member of the People and Culture Committee, and I served on the Audit Committee for several years. That time has reinforced my belief in the unique role the Bank and its people play in providing high-quality financial services to our customers and in supporting communities and retaining their trust.

You'll see from my Board experience, I've got a strong focus on health, housing and financial services, which to me all play an important role in all our lives and contribute to our prosperity. That diverse experience provides me with a deep understanding of good governance, strong strategic and commercial skills and closely aligns with Bendigo's culture and its purpose. As the Chair of the Board Risk Committee, I know good risk management supports and protects our customers and the Bank. The constantly evolving risk environment presents us with many challenges, some of which we've talked about today, including cyber security, privacy, operational risk, climate and conduct risk, to name a few. Successfully navigating our way through that environment is key to retaining our high levels of customer trust and to our resilience as a bank.

I am passionate about risk and about supporting our people, whether it's the executive or our customer-facing staff, to understand in practice how good risk management produces a better performing business and better service to our customers. And I'm really excited about the Bank's new 2030 strategy and the possibility it provides to build on our strong culture to be a better bank. I believe that I can make an important contribution to the Bank achieving its aspirations. With your support, I hope to continue to play my part in the Bank's future success for the benefit of our shareholders and our customers. Thank you.

Vicki Carter: Thank you, Victoria. I don't think we had any pre-submitted questions but we do have a question online in relation to your election.

Lauren Andrews: Yes, we have a question from Michael Francis Sanderson. He writes, "Ms Weekes, as Risk Committee Chair, you oversee franchise conduct and operational risk. Under your watch, Bendigo Bank will leave some communities without face-to-face banking services. How is this consistent with the Bank's risk appetite and other key performance indicators, such as Net Promoter Score and RepTrak metrics? Please table the committee's impact assessments and explain why shareholders should back your re-election."

Victoria Weekes: Thank you for the question and it's an important question. We won't be tabling details of risk appetite but exactly as you say, for those decisions which are made, we look at a number of factors around risk appetite both in terms of impact on communities, customer service but also sustainability of our organisation and where best we operate and how we operate. I think as to the details around closures and so on, the Chair and Richard as CEO have talked to that in some detail. But absolutely, all those factors bear upon the consideration and those decisions which are often made as a last resort. The last thing I'll say about RepTrak scores and customer satisfaction is we look at those very carefully as well, particularly in how we support the transition for our customers. So yes, the Risk Committee plays an important role in that regard, as does the whole Board.

Vicki Carter: Thank you, Victoria. Any further questions?

Lauren Andrews: No further questions online.

Vicki Carter: Okay, thank you. Well, with Victoria abstaining, I can confirm that the Board recommends to shareholders that they vote in favour of this resolution. The direct voting and proxy details received prior to the meeting are now being displayed for your information. They were 96.5% in favour of the resolution, 1.67% against the resolution and 1.83% open votes.

The next item of business asks shareholders to consider and, if thought fit, to pass as an ordinary resolution that Alastair Muir, who retires from office under Rule 72 of the Bank's Constitution, be re-elected as a Director of the Bank. I'd like to invite Alistair to address you in support of his re-election. Thank you, Alistair.

Alistair Muir: Thanks, Vicki, and good afternoon, ladies and gentlemen. It's an honour to be here with you today and to be considered for re-election. It's been a great privilege to serve as a Director on the Bendigo Board for the past three years. Bendigo is a very special organisation not just for shareholders and our people, but for the communities it serves, and I was drawn to join the Board by our mission to feed into the prosperity of these communities. This has very strong resonance for me.

My background is in technology, digital and AI, and I've helped major Australian and international companies with their growth strategies, digital transformations and also their adoption of AI. Since joining the Bendigo Board, I have served on the Board's Risk Committee, People and Culture Committee and currently chair the Bank's Technology and Transformation Committee. With my technology background, as you can imagine, I'm particularly excited about our 2030 strategy, with its increased technology focus to simplify and drive greater efficiency into our business and to deliver exceptional customer experiences that leverage our high levels of customer and societal trust. What I'm most excited about, though, is that by removing friction through digital innovation, we free our people to do what matters most: to deepen those connections with our customers and our communities, and look for ways to deliver even greater impact into the communities we serve. I look forward to continuing to serve you, our shareholders, and indeed, all of the Bank's stakeholders as we execute on this strategy. Thank you.

Vicki Carter: Thank you, Alistair. As there were no pre-submitted questions regarding this item of business, can we please take questions from shareholders here today in relation to the re-election of Alistair Muir?

Collin Brady: There are no questions from the floor, Vicki.

Vicki Carter: Thank you, Collin. Lauren can we please now take questions from people joining remotely today?

Lauren Andrews: We have one question from Michael Francis Sanderson. He writes, "Mr Muir, how does removing access to face-to-face banking services align with your duties when customers, including in outer regional and remote areas and older people, are most affected and still in need of these services? Separately, and in relation to scam and cyber risk, how are you protecting these customers and communities?"

Alistair Muir: Thank you, Michael, for the question. As Vicki and Richard have already outlined, digital and technology really play a key part for us in both being able to serve customers face-to-face but also remotely. It's also where 99% of all of our transactions occur today: digitally. That's actually a common statistic across all of banking in Australia. We focus on the use of digital and AI to actually be able to protect our customers online and protect them from cyber fraud. So, actually, in two parts of that question, digital and technology are an integral part of protecting those customers. I think it's something that we think about all of the time in terms of how we balance customer needs, both from a security point of view, but also how do we actually serve their needs in branch. I thank you for the question.

Vicki Carter: Thank you. With Alistair abstaining, I can confirm that the Board recommends that shareholders vote in favour of this resolution. The direct voting and proxy details received prior to the meeting are now being displayed for your information. There are 96.45% in favour of the resolution, 1.73% against the resolution and 1.83% open votes.

The next item of business asks shareholders to consider and, if thought fit, to pass an ordinary resolution that Travis Dillon, who retires from office under Rule 59 of the Bank's Constitution, be elected as a Director of the Bank. I'd like to invite Travis to address you in support of his election. Thank you, Travis.

Travis Dillon: Thank you, Vicki. Hello, my name is Travis Dillon. I've worked in the agricultural services sector for nearly all of my professional career over the last 30 years throughout many parts of regional Australia. In recent years, my roles have been in a non-executive director capacity, again predominantly focused in the ag and food sectors. I was also a non-executive director of Lifeline Australia for eight years, having recently retired from that board.

I was honoured to join the Board of Bendigo and Adelaide Bank in February and was particularly attracted to the Bank's longstanding purpose of feeding into the prosperity of its customers and communities. Given my background, I have a specific interest in the Bank's regional footprint and activity in the communities we serve. As a Director, I'm committed to supporting the Bank's leadership and ensuring it can deliver on its vision of being Australia's bank of choice. I feel I have the relevant experience having managed an ASX business for several years and more recently, developed a portfolio of ASX-listed entities as chair and as non-executive director. I'm a member of both the Board Risk Committee and the Board Audit Committee. I was very pleased to be appointed by the Board and I'm hoping that you, the shareholders, will now appoint me to serve the Company going forward. Thank you, Vicki.

Vicki Carter: Thank you, Travis. Collin, I don't think we have any questions here in the room, so we'll go to questions online. Thank you, Lauren.

Lauren Andrews: We have a question from Stephen Mayne. Stephen writes, "Could new Director, Travis Dillon, and the Chair comment on the recruitment process that led to his appointment? Which firm ran the process and did the Board interview any other candidates? Did Travis know any of our directors before engaging with the recruitment process?" He'd like to ensure this was a competitive process.

Vicki Carter: Okay. I'll take that, Travis. Yes, it was a competitive process, and we interviewed an extensive list of candidates. We always use a search firm to help us because we want the best possible directors for our Board. That won't just come through networks; it comes through an extensive search which was conducted by a search firm. I don't need to name them, I don't think, Stephen, but I can assure you that it was. The Board goes through a preparation of a long list with a search firm. We move to a short list. Every director on the Board interviews a few candidates and then we select the best possible candidate, and we certainly have that in Travis Dillon. Thank you.

Lauren Andrews: The next question is from Michael Francis Sanderson. "Mr Dillon, you are standing for election. Bendigo Bank has closed branches and ATMs and has retired agencies, reducing access to cash. Bank@Post has limits and cannot do PIN resets. Will you commit to minimum cash floors, ATM uptime targets, CIT frequency and float levels? And will you publish relevant audit and risk analysis?"

Vicki Carter: I'm happy to take that if you like, Travis. Yes. So, I think we've spoken at length, Mr Sanderson, around closures, et cetera, so I don't propose to address that again. Our ATMs, we do our best to ensure that they're available to customers when they need them. We certainly don't have any plans to phase out cash, et cetera. So, I think we've fairly covered your questions today and I think we might just leave it there but thank you for continuing to ask them.

With Travis abstaining, I can confirm that the Board recommends that shareholders vote in favour of this resolution. The direct voting and proxy details received prior to the meeting are now being displayed for your information. They are 97.47% in favour of the resolution, 0.68% against the resolution and 1.85% open votes.

We'll now move on to the next item of business. Abi Cleland, Chair of our People and Culture Committee, is available should any shareholder require further details in relation to the Remuneration Report. The Bank's remuneration framework balances market competitiveness, alignment with Company performance and shareholder interests. It's designed to attract, motivate and retain the talent that we need to deliver the Bank's strategy. Our approach to executive remuneration over the past year has not changed. We continue to pay our executives appropriately with a mix of fixed and variable reward that aligns with market practice and complies with regulatory requirements of CPS 511 and the financial accountability regime.

Shareholders are asked to consider and, if thought fit, to adopt the Remuneration Report for the Bank as set out in the Annual Financial Report for the financial year ended 30 June 2025. I can confirm that while each of our directors has a personal interest in this resolution, the Board recommends that shareholders vote in favour of it. As you know, the vote on the Remuneration Report is advisory only and does not bind the Bank or the Board. However, the Board will take the outcome of today's vote into consideration when renewing our remuneration practices and policies of the Bank. Collin, as there were no pre-submitted questions relating to the Remuneration Report, can we take any questions from shareholders here today?

Collin Brady: There are no questions on this matter from the floor.

Vicki Carter: Thank you, Collin. Lauren, can we please now take questions from those joining remotely today?

Lauren Andrews: We have a question from Stephen Mayne. Mr Mayne writes, "As the Bank has not disclosed the proxy votes with the formal addresses, can you disclose if any of the proxy advisers recommended a vote against any of today's resolutions, including this item?"

Vicki Carter: Thank you for the question, Mr Mayne, and thank you for the work you continue to do on behalf of retail Australian shareholders. We don't disclose proxy reports. They're not our reports to disclose. They are for the proxy advisers to make those public should they wish to do so but thank you for the question. Lauren, are there any remaining questions?

Lauren Andrews: Just one moment, Chair. Yes, we have another question from Michael Francis Sanderson. "Chair, this item seeks approval for 123,529 CEO performance rights valued at $1.575 million. FY25 included a goodwill write-down and a statutory loss. Yet, in FY22, LTI vested at 88.96% and STI was approximately one-third. How is this justified?"

Vicki Carter: Thank you. It's a good question. Long-term incentive arrangements are tested many years forward, so they're tested over four years and the entitlement under the LTI this year was based on performance over that four-year period, so not confined to the FY25 year. The goodwill impairment, I think we addressed earlier, but what I will say is it had no impact at all on regulatory capital. It had no impact at all on any STI outcomes for Richard or for any of our executives. Thanks for the question. Lauren, are there any further questions?

Lauren Andrews: No, Chair.

Vicki Carter: Thank you. That concludes all questions for this item of business. The direct voting and proxy details received prior to the meeting are now being displayed for your information. They are 95.69% in favour of the resolution, 2.52% against the resolution and 1.79% open votes.

Before I proceed to the final matter, please note that voting will close at the end of this meeting, so please submit your votes now if you haven't done so already.

The final matter is Item 6 in today's agenda. We're asking shareholders to consider and, if thought fit, to pass an ordinary resolution for approval of the grant of 123,529 performance rights to the CEO and Managing Director, Richard Fennell, as his long-term incentive for the financial year ended 30 June 2026 under the Bank's Omnibus Equity Plan and on the terms summarised in the Explanatory Notes of the Notice of this Meeting. The performance rights are an incentive plan that create alignment between the CEO and other executives' remuneration and shareholder outcomes. The performance rights only vest if the Bank meets key performance objectives, so these allocations are aligned to shareholder outcomes. These arrangements are consistent with market practice for ASX-listed organisations and financial institutions and are required to compete for the skills we require to manage the Bank. Collin, as there were no pre-submitted questions relating to the grant of performance rights for the CEO, can we take questions from any shareholders here today, please?

Collin Brady: There are no questions on this item from the auditorium. Thank you.

Vicki Carter: Thank you, Collin. Lauren, can we please now take questions from those joining remotely?

Lauren Andrews: Yes. We have a question from Stephen Mayne. "When disclosing the outcome of voting on all resolutions today, including this CEO LTI grant, can you please advise the ASX how many shareholders voted for and against? This will provide a better gauge of retail shareholder sentiment."

Vicki Carter: Thank you again for the question, Mr Mayne, and I understand where you're coming from in terms of seeing the votes from retail shareholders. We advise the ASX of the percentage votes against/for as I've displayed throughout the meeting today. We'll take on notice your suggestion and consider whether that would be practicable or desirable. Thank you very much. Lauren, are there any remaining questions?

Lauren Andrews: Yes, but it relates to general business, Chair. Would you like to take it now?

Vicki Carter: Yes, of course.

Lauren Andrews: This question is being asked by Victoria Ann Alwood. "The half-year dividend has been between $0.30 to $0.33 for two years. When will dividends increase with inflation?"

Vicki Carter: Thank you. Thank you for the question. It is a good one. Look, we balance the interests of our shareholders in ensuring that they get a good return on their investment with us with our capital needs and ensuring that that remains strong. We think we strike that balance well. We don't necessarily consider it through a peg-to-inflation perspective but it's an interesting perspective to take on. But as I said, I think we've appropriately balanced our investors' returns with the capital the Company needs to maintain to continue to be strong. But thank you very much for the question. Lauren, are there any remaining questions?

Lauren Andrews: Yes, we have one further question from Stephen Mayne. "When disclosing the outcome of voting on all resolutions today including..." My apologies, Chair, I think that this has been answered already.

Vicki Carter: Yes, that's fine. Thank you, Lauren. Any further questions?

Lauren Andrews: No further questions.

Vicki Carter: Thank you. Thank you, Lauren. I can confirm that with Richard Fennell abstaining, the Board recommends that shareholders vote in favour of this resolution. The direct voting and proxy details received prior to the meeting are now being displayed for your information. They are 94.63% in favour of the resolution, 3.53% against the resolution and 1.85% open votes.

Well, thank you, everyone, for your attendance and contributions. That does now conclude the items of business for today's meeting. I'll now close the voting. The results of the votes will be released to the ASX later on today. For shareholders here at the Ulumbarra Theatre, please join the Board and executive for afternoon tea. I thank you and I declare the meeting closed.

Previous Annual General Meetings

View previous notices of Annual General Meetings

Bendigo and Adelaide Bank's 2024 AGM

The Annual General Meeting (AGM) of Bendigo and Adelaide Bank Limited was held at the Capital Theatre Bendigo on Thursday 7 November 2024 at 11.00 am (AEDT).

Welcome to the Bendigo and Adelaide Bank's 2024 Annual General Meeting. Now our Chair, Vicki Carter.

Vicki Carter

Good morning, everyone, I am Vicki Carter, Chair of the Bendigo and Adelaide Bank and I’m also a fellow shareholder. It is just after 11am and we have a quorum. I declare the Banks Annual General Meeting open. I acknowledge the Traditional Owners of the many lands on which we are meeting on. I recognise their continuing connection to land, water, culture and community, and I pay my respects to elders, past, present and emerging. I am on the traditional lands of the Dja Dja Wurrung and the Taungurung Peoples of the Kulin Nation the traditional custodians of this land and waterways including the Loddon and Avoca rivers in the Bendigo region. We welcome and thank you for joining us today. I would like to acknowledge two special guests with us today, our former managing director Marnie Baker and former Chairman Robert Johanson, a huge welcome to you both. Please place your mobile phone on silent. Photography, filming, and audio recording are not permitted. And for those joining remotely who are deaf or hard of hearing, closed captions are provided, however, to activate these you will need to click on the CC button on your screen. A hearing loop is available for those attending here at the Capital Theatre. For those of you vision impaired, I have straight, light coloured hair and then wearing a navy suit with a cream shirt and in the background, I have a large image of the Bendigo and Adelaide Bank logo. The transcript of this AGM will be available on our investor website following the meeting. Out of respect for those who have joined us here and will be voting today, we have not released early voting details, however, we will provide voting details on the screen during the meeting for transparency. Let me introduce your Board and fellow shareholders. Alongside me is Richard Fennell, our CEO and Managing Director. Our non-executive directors here with you today are Abi Cleland, Richard Deutsch, Victoria Weekes, Alistair Muir, Margaret Payn, Daryl Johnson and David Matthews. And to their left we have our Company Secretary Belinda Donaldson, who will be assisting with today’s meeting. I would also like to acknowledge that in attendance today we have the Banks Executive members, as well as the Banks Lead Audit Partner Clare Sporle from EY. Also in attendance is Jim Kompogiorgas, from Link Market Services, who is acting as our Returning Officer for the meeting. Our General Manager Corporate and Public Affairs, Robert Musgrove will be assisting today, and Robert will outline the formalities for today’s meeting. Thank you, Robert.

Robert Musgrove